Episode

Episode

· 02:09

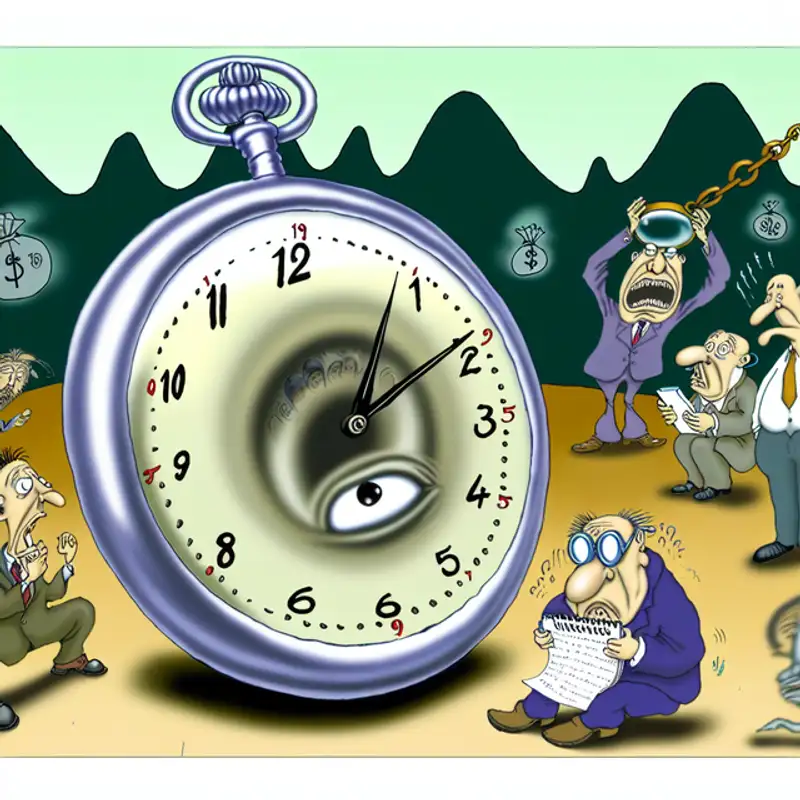

The article examines why investors and entrepreneurs should focus on the 10-year Treasury yield rather than the short-term interest rates set by the Federal Reserve. It explains that while the Fed’s rates are relatively stable, the 10-year yield—which has fluctuated between roughly 4.8% and 4.2% since the election—is a more sensitive barometer of economic sentiment and policy effects, including those from the Trump administration’s tariffs, deregulation, and immigration policies. Treasury Secretary Scott Bessent underscores the administration’s desire for lower rates to support the economy, even as rising yields risk tempering investor enthusiasm and economic growth. The piece also delves into the complex relationship between bond markets, inflation, future interest rate expectations, and policy moves by the government, noting that actions aimed at boosting economic growth could paradoxically contribute to higher long-term interest rates.

Key Points:

Why did the bond trader bring a ten-year-old to a party? Because he heard that even the yield wanted to join in on a long-term commitment!

Link to Article

Listen to jawbreaker.io using one of many popular podcasting apps or directories.