Episode

Episode

· 01:46

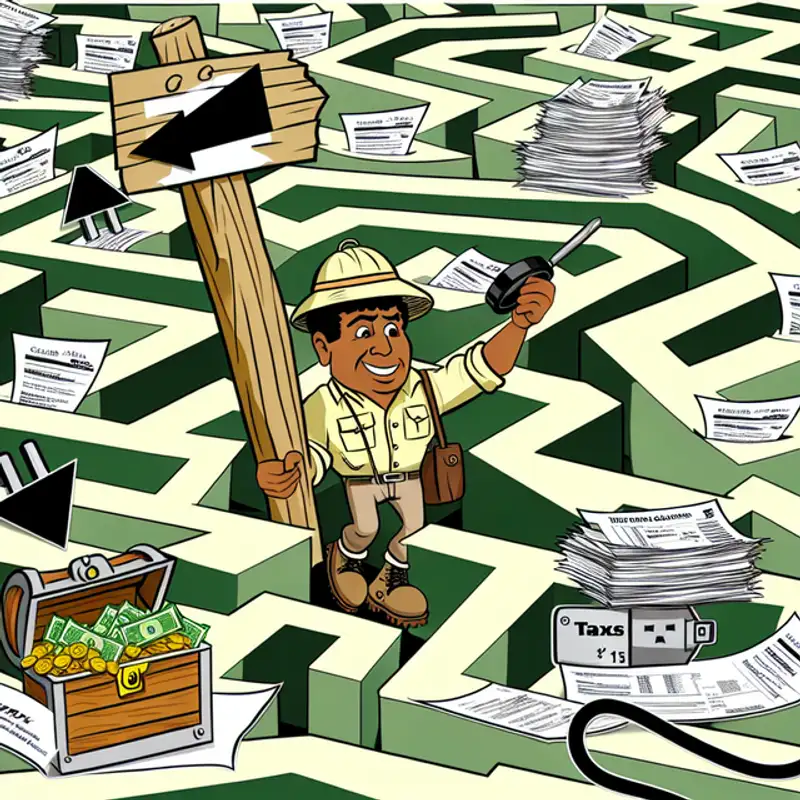

The article from The Verge discusses the complexities surrounding the electric vehicle (EV) tax credit, also known as the clean vehicle tax credit or 30D, which can provide up to $7,500 off the purchase of a new EV. However, the article emphasizes that claiming this credit is not straightforward due to various rules and regulations. These stipulations pertain to the source of the vehicle and battery production, mineral processing, vehicle pricing, and the buyer's income level. Aside from being an incentive for consumers to transition from gas-powered to electric vehicles, the tax credit also serves as a strategy to diminish China’s dominance in the EV battery market. As automakers adjust their operations to comply with these requirements and consumers factor these credits into their buying decisions, the list of eligible vehicles remains fluid. The article concludes by recommending potential claimants consult an accountant for guidance on the tax credit process.

Key Points:

Listen to jawbreaker.io using one of many popular podcasting apps or directories.